Cushman & Wakefield publishing „Property Times Office Poland”

According to Cushman & Wakefield’s latest „Property Times Office Poland” report, 2015 was record breaking in terms of the annual office space supply in Poland. The report analysed the market situation in Poland’s nine largest cities (Warsaw, Kraków, Wrocław, Tricity, Katowice, Poznań, Łódź, Szczecin and Lublin). The total office stock amounted to 8.2 million sq m as of the end of 2015, with 56% of new office space delivered outside of Warsaw. The demand, reflected in the lease transaction volume, grew by 40% as compared to the previous year, and the highest leasing and development activity was recorded in Warsaw, Kraków, Wrocław and Tricity.

In 2015, 643,000 sq m of modern retail space was completed, with 366,000 sq m in the regional markets analysed and 278,000 in Warsaw. Major projects delivered to the market included Poznań Business Garden in Poznań, Dominikański in Wrocław, Postępu 14 in Warsaw, and Alchemia II in Gdańsk.

Annual take-up increased by 40% across the country, as compared to 2014. This growth was faster in regional cities, where it amounted to 44% (580,000 sq m). The highest demand outside of Warsaw was recorded in Kraków (184,000 sq m) and Wrocław (113,000 sq m). Due to the strong demand, developers remain active both in Warsaw and other major cities. More than 1.4 mn sq of space is currently under construction, of which ca. 765,000 sq m in regional markets.

“2015 was another year of rapid development of the Polish office market, with regional cities leading in terms of rate of growth. The main assets of these markets are the talent pool and a large number of qualified employees, students and recent graduates ready to provide services of the highest quality in the BPO/SSC/IT sector. Global corporations have more and more confidence in the Polish market, and the general outlook for the coming years is more than optimistic. I am glad that thanks to working together with our clients, we advised on about 20% of regional transactions in 2015," said Krzysztof Misiak, Partner, Regional Cities Director, Cushman & Wakefield.

“2015 was another year of rapid development of the Polish office market, with regional cities leading in terms of rate of growth. The main assets of these markets are the talent pool and a large number of qualified employees, students and recent graduates ready to provide services of the highest quality in the BPO/SSC/IT sector. Global corporations have more and more confidence in the Polish market, and the general outlook for the coming years is more than optimistic. I am glad that thanks to working together with our clients, we advised on about 20% of regional transactions in 2015," said Krzysztof Misiak, Partner, Regional Cities Director, Cushman & Wakefield.

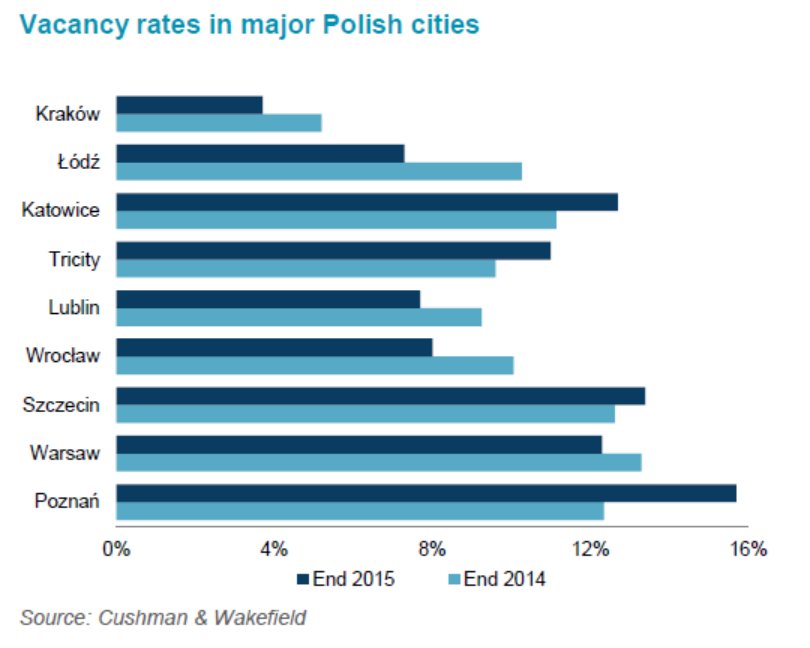

Despite the high annual supply, the demand for modern office space remained strong enough for the vacancy rates to not fluctuate by more than +/- 3 pp. Only in Poznań, due to record-breaking supply levels, did this index significantly grow, from 12.4% to 15.7%. The average vacancy rate for the nine cities was at 10.9% as of the end of 2015, with only Kraków, Wrocław, Łódź and Lublin scoring below this level.

Rent rates for modern office space in new buildings located in regional cities outside of Warsaw remained stable, at between EUR 10 and 15.5 per sq m per month.

Forecast for 2016–2017

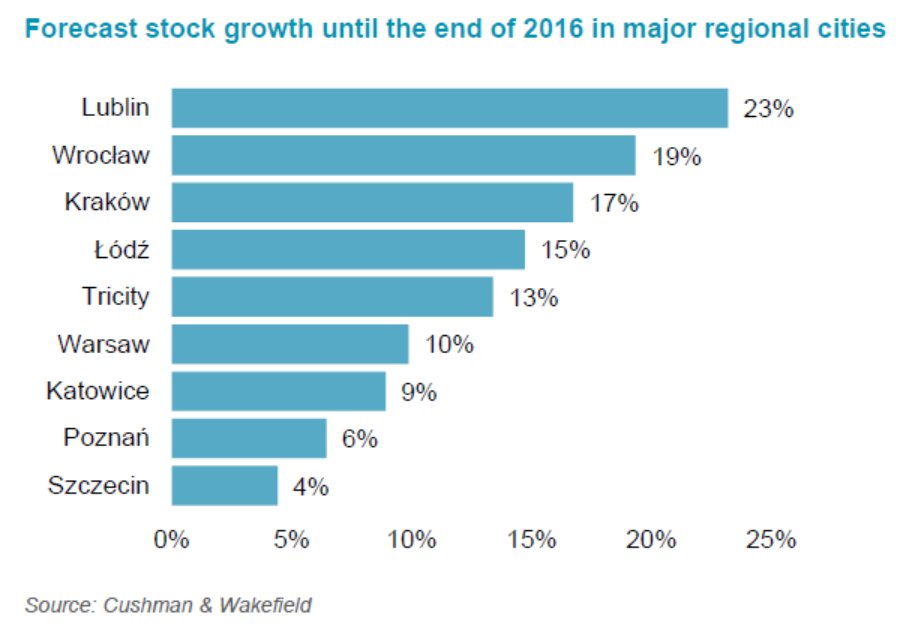

In the years 2016–2017, modern office stock will continue to grow (at an estimated level of ca. 700,000 sq m). When it comes to regional cities, the highest level of activity is expected in the most mature markets: Kraków (180,000 sq m), Wrocław (165,000 sq m) and Tricity (140,000 sq m). Lublin will lead the market in terms of the dynamics of growth, with an estimated increase in supply by 23%, followed by Wrocław (19%) and Kraków (17%). Due to the large number of projects in development, a further downward pressure of rent rates is to be expected.

“Developer activity is still strong, both in Warsaw and in regional cities. The demand for modern office space is also high, as we are currently experiencing a ’tenant’s market’. Unless external factors, such as the macroeconomic situation, slow this trend, we can expect another record-breaking year on the modern office space market,” said Kamila Wykrota, Head of Consulting & Research, Cushman & Wakefield.

Cushman & Wakefield