Global VC Investments in Marketplaces Nearly Triple to Historical High of $28 Billion in Q1 2021

Marketplaces are continuing to benefit from shifts born out of the pandemic and show no signs of slowing down.

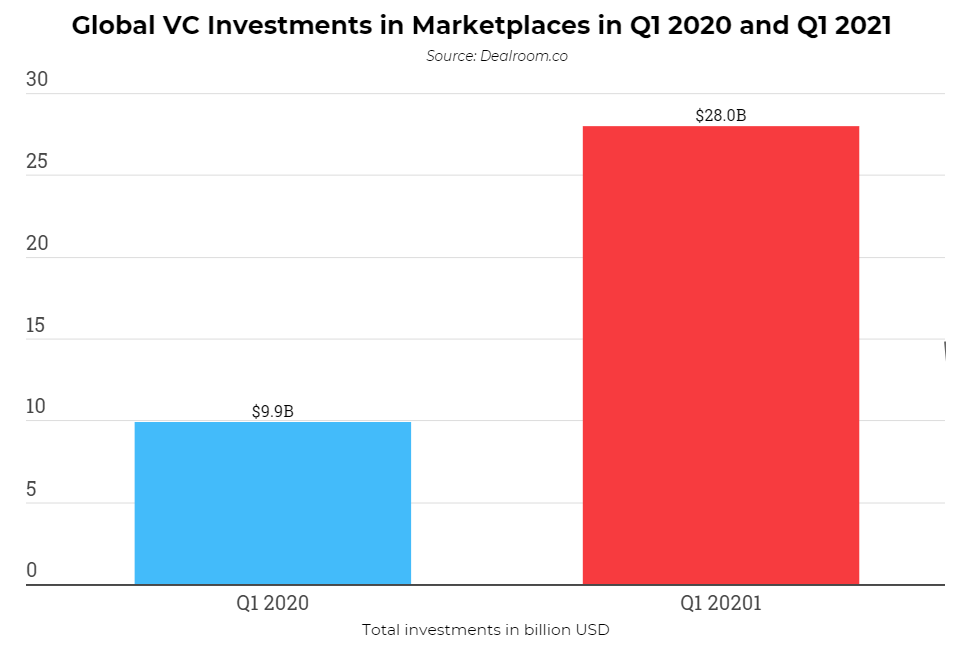

According to the research data analyzed and published by Definanzas.com, worldwide VC investments into marketplaces hit a new all-time high in Q1 2021. With SPACs and mega-rounds as key drivers of the growth, the figure rose to a record $28 billion during the period.

It was almost three times the $9.9 billion raised during the same period in 2020 and $4 billion higher than the previous record high. A good number of the investments were directed toward last-mile delivery services and logistics.

It was almost three times the $9.9 billion raised during the same period in 2020 and $4 billion higher than the previous record high. A good number of the investments were directed toward last-mile delivery services and logistics.

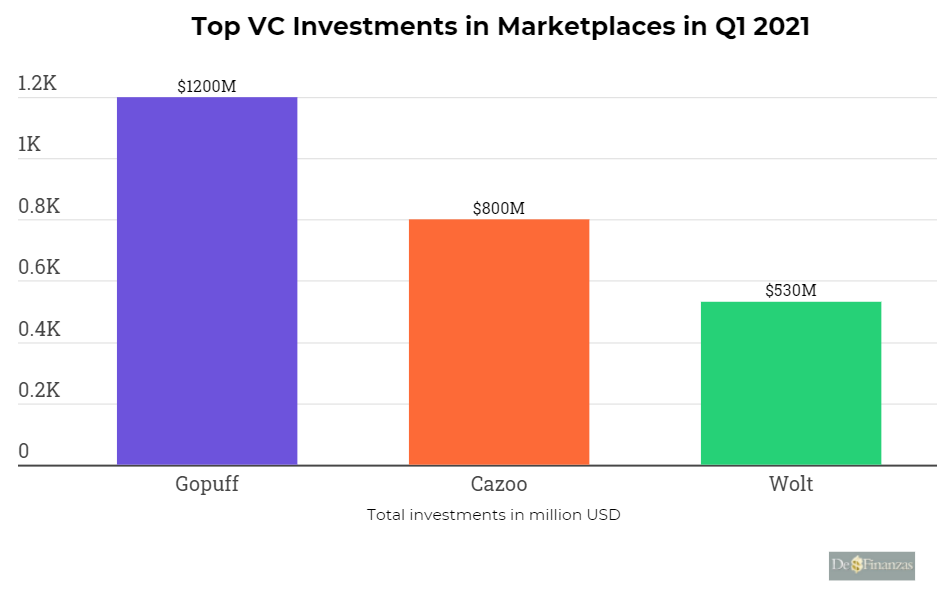

Among the notable rounds recorded during the quarter was Gopuff’s $1.2 billion round that took place in March 2021. The digital convenience store’s Series G round went on record as the second largest in the period across all industries and sectors.

Noteworthy too were car marketplace Cazoo’s $800 million round and the $530 million Series E round by food delivery firm Wolt.

A similarly high inflow has carried into Q2 2021. In the first five weeks alone, VCs poured in $12 billion into the sector. The figure includes $312 million for Kry, Travelperk’s $160 million and $115 million into BlaBlaCar.

MARKETPLACE UNICORNS’ VALUATION MORE THAN DOUBLES TO $5 TRILLION

MARKETPLACE UNICORNS’ VALUATION MORE THAN DOUBLES TO $5 TRILLION

In addition to the massive increase in VC funding into the sector, valuations of marketplace unicorns have also shot up remarkably. There was a 70% uptick in the valuations of marketplace unicorns, from $2.2 trillion in 2019 to $5 trillion in 2021.

Overall, marketplace unicorns currently number 370, 81 of them have joined the ranks in 2020. Among these, the top 30 marketplaces account for $3.9 trillion or 79% of the total value, marking a collective increase of $1.6 trillion in value. Worldwide, there are 30 marketplaces valued at $20 billion or higher, with Amazon in the lead, followed by Alibaba and Meituan.

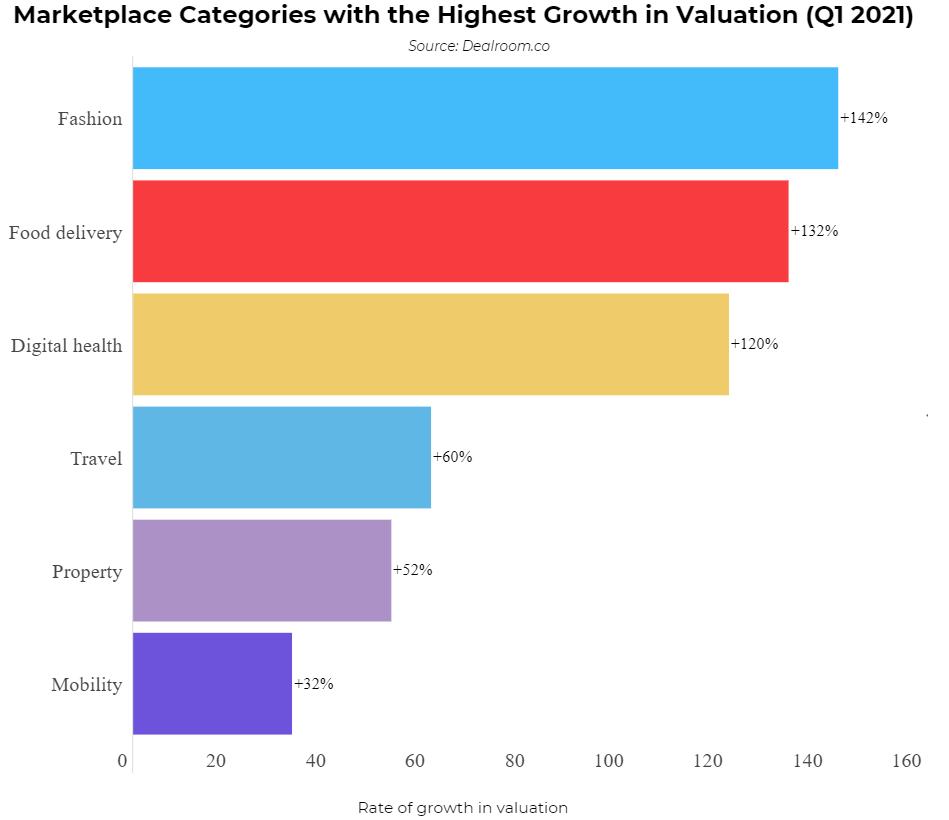

Fashion, health, delivery and logistics were among the categories with the highest growth in valuation in Q1 2021. For fashion, there was an impressive 142% jump while food delivery soared by 132% and digital health by 120%.

Illustrating the growth, Delivery Hero saw its market capitalization rise by 76% in the year between April 2020 and May 2021. Within the same duration, its revenues also doubled. Hello Fresh, on the other hand, posted a 241% jump in valuation alongside a 106% increase in revenues. eCommerce fashion site Zalando grew its value by 83% and its revenues by 25%.

Some of the sectors that took the hardest hit during the pandemic include travel, property and mobility. However, it is interesting to note that the marketplaces in these sectors still posted growth in valuation. Mobility firms increased their valuation by 32%, travel firms by 60% and property firms by 52%.

GLOBAL MARKETPLACE SALES TO GROW TO $8.8 TRILLION BY 2025

The pandemic introduced massive paradigm shifts in the way businesses and consumers shop. As a consequence, the one-year surge in eCommerce share of total sales in 2020 was almost as high as that of the previous decade.

To illustrate the growth, consider the US market. As of Q1 2010, eCommerce share of total retail sales stood at 4.20%, rising to 10.50% by Q1 2019 according to the US Department of Commerce. Between Q1 2019 and Q2 2020, the figure rose by nearly six percentage points to 16.10%.

On the global landscape, eCommerce accounted for a 7.4% share of total retail sales in 2015, rising to 13.6% in 2019. Between 2019 and 2020, there was a massive jump to 18% according to eMarketer. Though growth is forecast to taper down in 2021 and the coming years, the uptrend is set to continue. In 2021, it is projected to rise to 19.5% and by 2024, it will have shot up to 21.8%.

According to Be Shaping the Future (Be STF), global marketplace sales are forecast to grow at a 20% CAGR between 2020 and 2025. At the end of the forecast period, they are expected to be worth $8.745 trillion, up from $3.458 trillion in 2020. By that time, marketplaces’ share of online sales will be 24%, up from 19% in 2020.

The B2C segment of online marketplaces is the most highly developed. As of 2020, it accounted for 53% of all B2C digital sales or $2.450 trillion globally. During the forecast period, B2C sales via online marketplaces are expected to grow at a 14% CAGR, reaching $4.723 trillion. By then, they will account for a 61% share of total online B2C sales.

On the other hand, the B2B segment is still in its infancy stages, accounting for a mere 7% share of total B2B digital sales in 2020. Highlighting the huge opportunity in this segment, Be STF projects growth at a 32% CAGR during the forecast period.

On the other hand, the B2B segment is still in its infancy stages, accounting for a mere 7% share of total B2B digital sales in 2020. Highlighting the huge opportunity in this segment, Be STF projects growth at a 32% CAGR during the forecast period.

Sales will rise from $1 trillion to $4 trillion in that duration, while the share will double to 14%.

Nica San Juan