Over 52% of e-commerce websites globally prefer Stripe payment processor

With electronic payments shaping the online transactions sector, there is no denying that some big players have established an edge over others to become the defacto choice for users. Currently, different electronic payment solution providers have invested heavily to dominate emerging players.

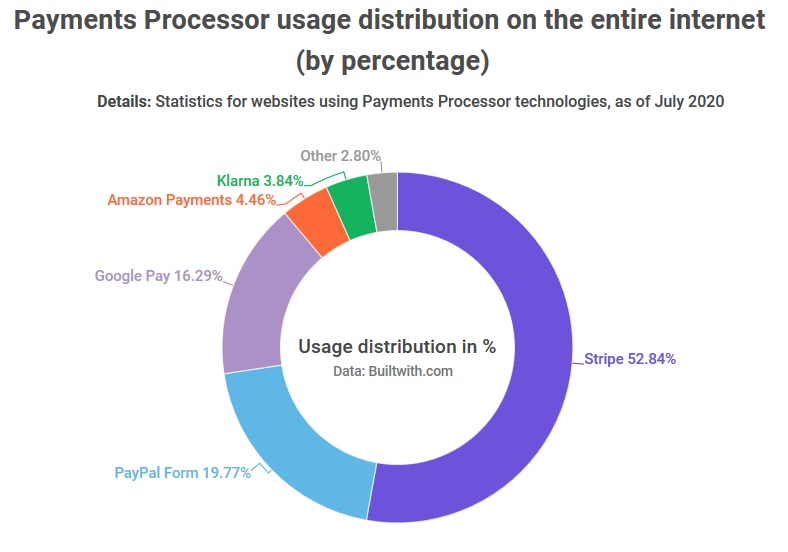

Data obtained by Buy Shares shows that Stripe accounts for a staggering 52.84% of all e-payments online. PayPal Form is second accounting for 19.77% of all online payments. Google Pay’s 16.29% share ranks it in the third slot followed by Amazon Payments at 4.46%. Klarna has the fifth-highest online payment distribution at 3.84%. Other e-payment solutions account for the remaining 2.80%.

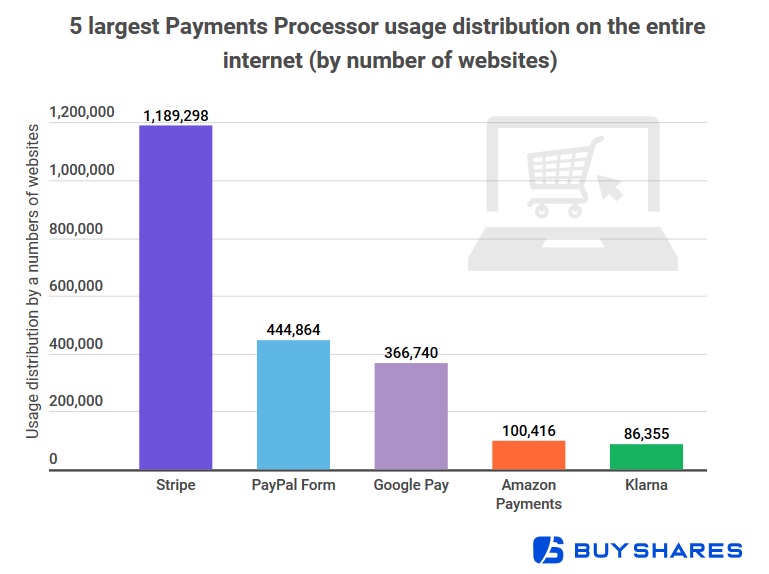

Our research also overviewed the five largest payment processors usage distribution on the entire internet based on the number of websites. Stripe takes the lion’s share with a presence on 1,189,298 websites while PayPal Form comes second at 444,864. In the third slot, there is Google Pay with usage on 366,740 websites. Amazon Payments is fourth with acceptance on 100,416 websites. In the fifth slot, there is Klarna with 86,355 websites.

Stripe, PayPal establish dominance

The e-payment solutions enable merchants to pay for goods and services through an electronic medium as opposed to the traditional use of checks or cash. With a revolution in internet-based banking and shopping sector, electronic payment systems have been rising rapidly. Over the years, electronic payments have been improving to offer more secure online payment transactions directly leading to a decrease in cash transactions.

From our research data, the success of Stripe should not come as a surprise considering that the company has a heavy investment in its system. The payment solution has an edge over PayPal thanks to its nature. Stripe is liked by teams with in-house programmers thanks to its customizable development tools. It’s a popular pick for small businesses but is also used by big companies like Lyft. Generally, Stripe has invested sufficient time, money, and resources to building everything developers need to be successful and get up and running with the system.

However, Stripe and PayPal occupy the top spots thanks to their transparent nature. The two are very transparent about their fees and they both offer plans with no setup costs, basic monthly fees, or contracts. Both Stripe and PayPal are known for their ease of use abilities. Both companies have made it simple for customers to pay online.

Just like any other sector, the online payment systems have the potential of reaching significant heights in the coming years, thanks to factors like a mobile explosion. With smartphone usage on the rise, many payment processors are bound to take advantage and customize their systems to leverage this potential.

The current coronavirus pandemic has accelerated the online payment systems, a situation likely to stay around for the unforeseen future. The pandemic has spurred growth in eCommerce through basic commodities like groceries and medical supplies. Consumers are practicing social distancing which is key in curbing the virus spread. Additionally, the use of cash transactions is being discouraged as a measure to flatten the curve.

The future of electronic payments

In future other trends like the introduction of wearable technology are bound to spur online payments growth. For example, payment through the wrist band system using radio frequency identification bands is expected to be massive especially for music concerts and festivals. Furthermore, biometric payments are expected to have a place in online payments. With technological advancements, fingerprint scanners could be used to facilitate payments for products or services, with account information linked through the internet to each person’s fingerprint.

However, for the online payment solution systems to fully revolutionize the industry they need to surpass some barriers like cross border transactions. Cross border transactions are sometimes slow and inefficient and payment solutions need to work with partners to ensure cash flow is seamless. It is, therefore, encouraging to see the emergence of transnational systems that will decrease reliance on third networks.

Additionally, security has always been a major factor in adopting electronic payment solutions. With e-commerce advancing, there exist fraudulent elements ready to take advantage of any flaws in the system. Electronic payment providers need to invest more in fraud-monitoring tools such as the customer account, validation services, and purchase tracking to single out suspicious activities.

Justinas Baltrusaitis