Pharma US Digital Ad Spend Up by 242% YoY in the First Two Months of 2021

The pharmaceutical industry, like many others, has been going through a digital transformation, bolstered by the pandemic. And so has its digital advertising budget.

The pharmaceutical industry, like many others, has been going through a digital transformation, bolstered by the pandemic. And so has its digital advertising budget.

According to the research data analyzed and published by ComprarAcciones.com, the pharmaceutical ad spend in the US rose by 41% overall in January and February 2021. The uptick came as a result of robust growth in digital ad spend, which shot up by 242% year-over-year (YoY) within the same period.

Notably, the spending has increased considerably despite the fact that the number of brands remained flat in that duration.

On the other hand, print ad spend in those two months fell by 23% YoY. Admittedly, it is typical of companies in the industry to spend less at the beginning of the year. But the increasing popularity of digital advertising has contributed significantly to the decline.

According to Kantar, US pharma digital ad spend soared by a remarkable 43% in 2020. In the same period, ad spend on print channels fell by 16% while out-of-home channels posted an 81% decline.

The annual drop in print was a considerable improvement over its lowest point in Q2 2020, when it was down by 33%.

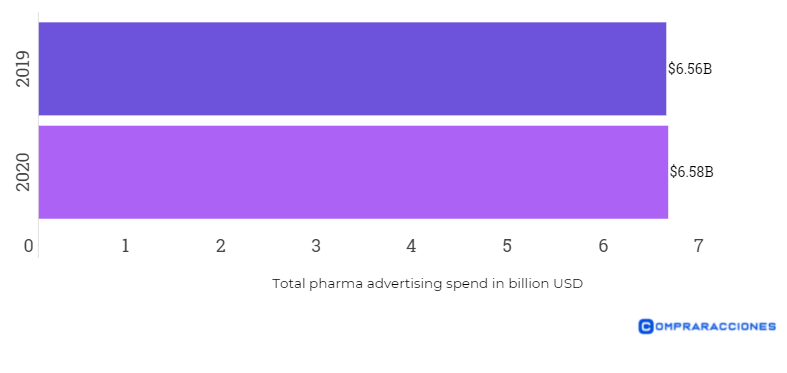

Overall pharma ad spend during the year totaled $6.58 billion. That was slightly higher than the 2019 total of $6.56 billion. However, it was a noteworthy feat considering that overall US spend on advertising tumbled by 13% YoY.

Beyond pharma, one of the few categories to post growth in digital ad spend was the ‘fitness, diet, spa’ segment. For instance, in the period between December 2020 and January 2021, the category almost quadrupled its digital ad spend. It shot up from $9.46 billion to $36.37 billion. It was among few categories to post growth following the huge advertising rollercoaster ride that takes place annually after the festive season.

Top Five US Pharma Advertisers Spent $152 Million on Social Media Ads

Health was a key focal point during the year due to the pandemic. According to a Cleveland Clinic study, 68% of US residents paid greater attention to health-related risk factors besides COVID-19. Thus, while other marketers slashed ad budgets, pharmaceutical marketers rode the wave and managed to notch a gain.

In the past, new drug launches have typically been the top drivers of pharma ad spending. But in 2020, there was a shift in investment to drugs associated with conditions like cancer. These have never received any significant investments in previous years.

Moreover, pharma brands have also had patient privacy concerns when considering digital advertising. This has limited targeted digital advertising for conditions such as cancer.

TV advertising was the top category in terms of ad spend, accounting for 75% of the 2020 total, at $4.58 billion. It marked a slight increase from 2019 when TV accounted for 73% of the US pharma ad investment.

The dominance of television comes about from its ability to maintain brand awareness across a vast audience segment. To reach specific audiences, companies in the sector turn to targeted video. This approach narrows down on specific age groups, gender, media preference and location among other aspects.

According to Pathmatics data, the top five advertisers in US pharma spent a cumulative $152 million on social media ads. The social ad spend analytics firm tracks spending on Facebook, Instagram and Twitter.

Pfizer was the top spender, investing a total of $55 million, while GlaxoSmithKline was second with $48 million. Allergan spent $19 million, Merck $16 million and Novartis, $14 million.

Healthcare and Pharma Digital Ad Spend to Surpass $11 Billion in 2021

On average, pharmaceutical brands now allocate 66% of their marketing budgets to digital. COVID-19 drove the shift by pushing digital marketing capabilities that were not prioritized to the fore.

According to eMarketer’s projections, digital ad spend in the US healthcare and pharmaceutical industry is expected to surpass $11 billion in 2021.

In 2020, the two sectors combined saw a 14.2% uptick reaching $9.53 billion. It was the fastest-growing industry behind consumer electronics and computing products, which grew by 18.0% during the year.

eMarketer’s projection for 2021 is in the same environs as Statista’s estimate of $11.25 billion, marking an increase of 18% YoY. Its share of overall US digital ad spending which was 7.1% in 2020 is projected to drop slightly to 6.9%.

Nica San Juan