Post-IPO Activity in the Gaming Industry Soared by 3,000% in Q4 2020

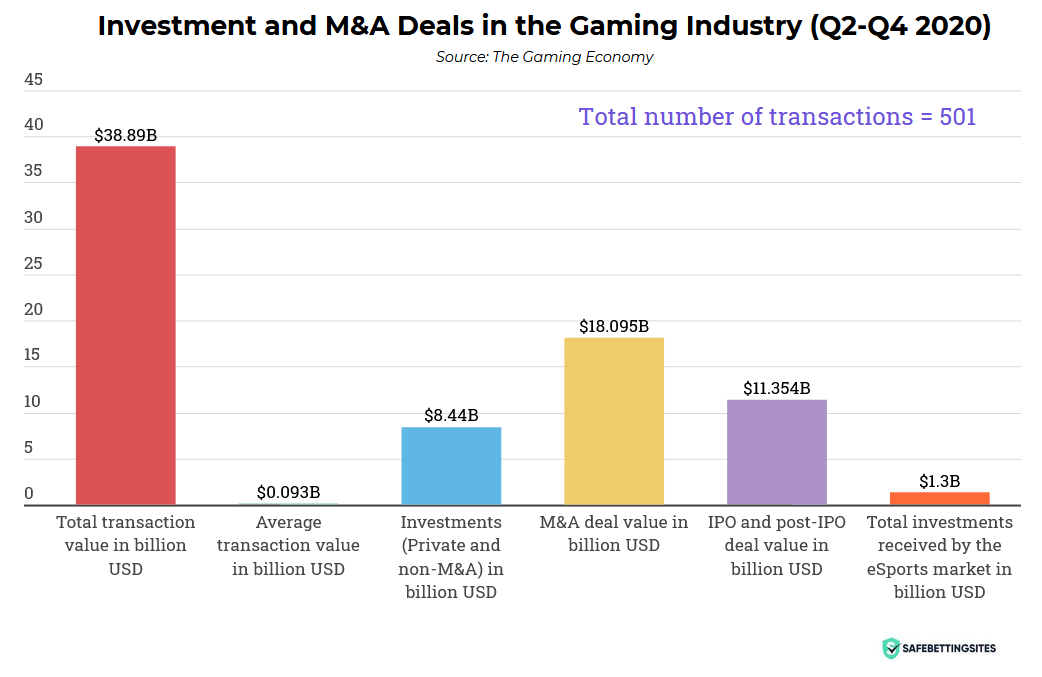

There was an explosion of merger and acquisitions (M&A) activity in 2020’s gaming scene following a shift in consumer attention to video games. The total investment and M&A activity in 2020 reached an estimated $40.57 billion across 642 deals.

According to the research data analyzed and published by Safe Betting Sites, the investment activity was concentrated in the period between April 2020 and December 2020. The industry saw a total of $37.89 billion injected across 406 disclosed deals. From this amount, eSports companies received more than $1.3 billion.

During that period, M&A transactions surpassed $18 billion in value, accounting for slightly less than half (47.8%) of the total value reported. There was a total of 20 M&As whose value surpassed $100 million, four of them breaching the $1 billion mark. These included Microsoft’s $7.5 billion acquisition of ZeniMax and Tencent’s $1.5 billion acquisition of Leyou Technologies. The other two were EA’s $1.2 billion acquisition of Codemasters and Zynga’s $1.8 billion acquisition of Peak Games.

IPO and post-IPO transaction value was $11.35 billion. For this market, 2020 got off to a particularly slow start as only two companies went public in Q1 at a cumulative value of $8.08 million.

In Q2 and Q3, activity picked up with a total of 14 deals valued at a collective $5.48 billion. Following that spike, Q4 saw relatively muted performance with three deals valued at a combined $214.4 million.

The largest IPO was NetEase’s secondary listing on the Hong Kong Stock Exchange valued at $2.68 billion. Noteworthy too was the listing of Unity Software on the New York Stock Exchange valued at $1.3 billion.

Guild Esports Becomes First eSports Firm on LSE Following $26 Million Listing

A notable first for the IPO market was the listing of Guild Esports on the London Stock Exchange (LSE) through a $25.85 million listing. The fledgling firm which was popularized by the involvement of David Beckham became the first eSports firm to get listed on the LSE.

2020 also saw a rapid rise in popularity of Special Purpose Acquisition Companies (SPACs). eSports and mobile games company Skillz became the first gaming firm to list under a blank-check company. It merged with Flying Eagle Acquisition Corp for $690 million and raised a further $159 million in institutional investments.

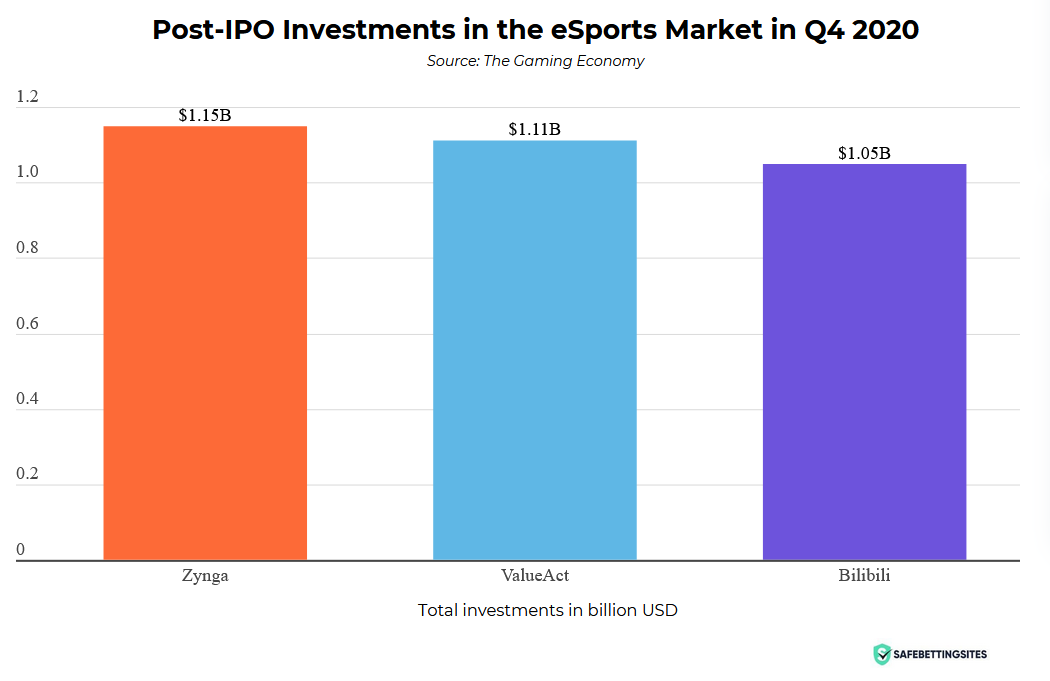

While post-IPO activity declined by 91% in Q3 2020, investment in public companies shot up by 2,966% in Q4 2020 reaching $2.82 billion. Among the factors driving this spectacular upsurge was the reorganization of credit facilities and private share issuances by companies that were active in M&A activity during the year.

For instance, following the acquisitions of Rollic and Peak Games, Zynga raised $1.15 billion. It raised the amount through a $425 million revolving credit facility for three years and a $726 million convertible notes private offering.

Other noteworthy post-IPO investments were ValueAct’s $1.11 billion holdings in Nintendo and Bilibili’s $650 million convertible bond issuance. Bilibili also raised a cash investment worth $400 million from Sony.

Non-M&A investment activity in publicly listed companies was nearly at par with IPOs in terms of value. The total amount raised between April and December 2020 was $5.88 billion from 32 transactions. On the other hand, non-M&A investments in private gaming companies totaled $8.44 billion in 2020. They accounted for a 22.3% share of total transaction value. The most noteworthy deal was the $1.78 Epic Games investment from primary capital and secondary purchases.

BITKRAFT Ventures $165 Million Funding, Highest eSports Investment 2020

Narrowing down to the eSports market, BITKRAFT Ventures took home the biggest investment in 2020. The VC fund, which is the biggest in eSports, aimed to raise $125 million but far surpassed the target, raising $165 million according to Dexerto. It has investments in Epic Games, VENN and Epics.gg among others.

VSPN bagged the second largest investment, $100 million. Known for hosting League of Legends, Honor of Kings and CrossFire events, VSPN is a major industry player in Asia. Chinese conglomerate Tencent led the investment.

In the third spot was the Mobile Premier League, which raised $90 million through a Series C funding round. Among the investors in its Series C funding round were Sequoia India, SIG and RTP Global. The mobile gaming platform now features more than 70 casual and hyper-casual games.

Meanwhile, Swedish startup G-Loot received $56 million for expansion from Europe into North America. HLTV was acquired by Better Collective in a $42.1 million deal while FaZe Clan raised $40 million in a Series A funding round.

Other large investments rounding up the top 10 included ReKTGlobal’s $35 million funding, Statespace’s $29 million, Guild Esports $27 million and VENN’s $26 million.

Nica San Juan